Stiglitz: Euro is an utter failure

The Economist reviews the latest book by Nobel prize winner Joseph Stiglitz:

The Economist -- On course to fail (Aug 20, 2016)

THOSE in search of an antidote to the anxieties that arise from Britain’s vote to leave the European Union should avoid the latest book from Joseph Stiglitz. Its subject is the euro, which has hitherto been the main font of fears for Europe and (his analysis suggests) will soon be once again. It is a meaty subject, suited to a big-name economist. Mr Stiglitz has won a Nobel prize, served as a feather-ruffling chief economist for the World Bank and written several books with a fair claim to prescience, notably, “Globalisation and Its Discontents”, published in 2002.

So what does The Economist, which prides itself on its sober writing, think of Stiglitz' book?

Mr Stiglitz is at his best when coolly analytical and at his most trying when settling scores. Yet on the essentials, he is surely right. Without a radical overhaul of its workings, the euro seems all but certain to fail.

Jeet Heer interviews Stiglitz for The New Republic:

Heer: Why is the euro such a problem?

Stiglitz: It impeded or made impossible the ability to adjust when there was a shock. [...]

So the combination of austerity with the euro’s structural problems is the bigger problem?

That’s right. The novel part is that it’s not the structural problems in individual countries, it’s the structural problems in the Eurozone. European officials thought that austerity was part of what they called their “convergence policies,” of trying to bring countries together. Instead, it actually made things worse. There’s more inequality within countries and more disparity across countries.

Die Welt notes that criticism is not just coming from left-of-center Stiglitz but also from ordoliberals like Hans-Werner Sinn:

Die Welt -- Nobelpreisträger fordert das Ende des Euro (Aug 19, 2016)

Stiglitz ist nicht der erste renommierte Ökonom, der dem Euro eine Mitschuld an der wirtschaftlichen Malaise der Euro-Zone gibt. Bereits im vergangenen Jahr hat der ehemalige Ifo-Chef Hans-Werner Sinn seine Streitschrift „Der Euro: Von der Friedensidee zum Zankapfel“ veröffentlicht. Damit stehen nunmehr Ökonomen vom linken bis zum konservativen politischen Spektrum der Gemeinschaftswährung kritisch gegenüber und fordern die Abschaffung.

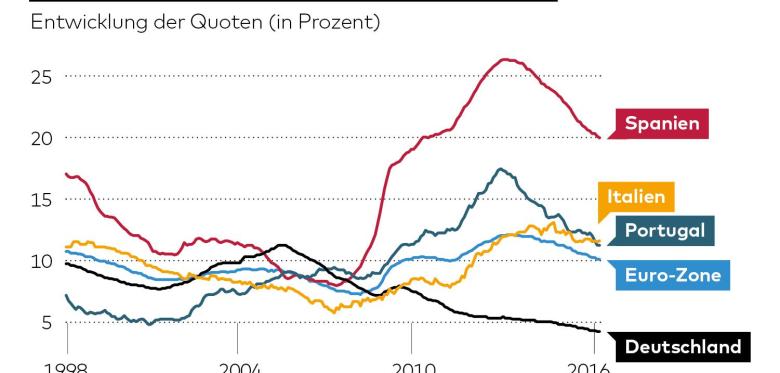

Sinn and Stiglitz both support the conclusion that the Euro, which was meant to unify the continent, drove it apart. Unemployment figures between member states have diverged:

Bei der Beschreibung der Euro-Folgen sind sich Stiglitz und Sinn überraschend einig. Die Gemeinschaftswährung habe Europa wirtschaftlich auseinandergetrieben. Sichtbar wird das nicht nur an den unterschiedlichen Arbeitslosenraten. In Spanien liegt sie rund vier Mal höher als in Deutschland. Auch zwischen Deutschland und Italien klaffen Welten. Lag die italienische Rate vor zehn Jahren noch unter der deutschen, hat sich das inzwischen vollkommen verkehrt.

(credit: Die Welt)

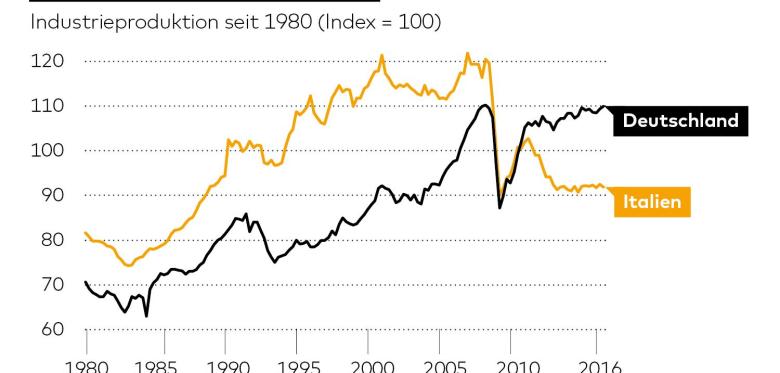

While productivity plummeted and barely recovered:

In der Folge habe der Euro das Wachstum behindert, die Desintegration gefördert und sich als Investitionsbremse entpuppt. In der Euro-Zone sei der Output pro Arbeitskraft seit 2007 lediglich um 0,6 Prozent gestiegen, verglichen mit rund vier Prozent außerhalb des Euro-Raums.

(credit: Die Welt)

The European Central Bank reported as much in May 2015:

Little real convergence has taken place among the euro area economies since the establishment of the euro, despite initial expectations that the single currency would act as a catalyst for faster real convergence. There is no clear relationship between relative GDP per capita levels in 1999 and their relative growth between 1999 and 2014. In fact, looking at the period as a whole, there is some evidence of divergence among the early adopters of the euro, given that over 15 years a number of relatively low-income countries have maintained (Spain and Portugal) or even increased (Greece) their income gaps with respect to the average. Moreover, Italy, initially a higher-income country, recorded the worst performance, suggesting substantial divergence from the high-income group.

But let's not part on a faceless communiqué from Frankfurt. Here's Yannis Varoufakis, the photogenic former Finance Minister of Greece, writing for Die Zeit in July:

Yannis Varoufakis -- The Eurozone After Brexit – Die Zeit (in English and German) (Jul 20, 2016)

When the hope of stability, convergence and shared prosperity is replaced with the reality of instability, divergence and the demise of pan-European pursuits, it is no great wonder that most Greeks, Italians but also Germans, from both the Left and the Right of the political spectrum, turn hostile to the single currency, indeed to the EU that spawned it.