Till death do us part: how pension reforms fracture the EU

The Polish government of the arch-conservative PiS party (Law and Justice) wants to reverse the increase in retirement age in Poland. They plan to pay for it by looking for change in the couch:

Radio Poland -- Polish government backs lowering retirement age (Jul 20, 2016)

Asked about funding for the reform, he stressed that the funds will be there thanks to, among other things, tackling tax evasion. "We will have funds, there is money for this. We are doing everything possible to tighten the tax collection system, including VAT collection," he said.

The retirement age was increased in 2013 by the liberal Civil Platform administration under Prime Minister Donald Tusk (who is now the President of the European Council):

Agnieszka Chłoń-Domińczak -- Reversing the 2013 retirement age reform in Poland (2016)

From 2013, this age was increased gradually by 4 months per year; it should have reached 67 for men in 2020 and for women in 2040 [...] Even with this reform fully in force, the challenge of pension adequacy would have remained severe in Poland. The projected net theoretical replacement rate (TRR) at standard pensionable age in 2053 is estimated at 43.4% - i.e. an average wage earner who started his career in 2013 at the age of 25 could expect 43.4% of his last wage as a pension payment. By way of comparison, the net TRR for retirement age at 65 (instead of 67) would be 37.7%; it would be 35.9% for a retirement age of 63.

The increase in the retirement age was wildly impopular:

The increase in the retirement age was not supported by society. According to an opinion poll, 83% of Poles did not approve of it (CBOS, 2011)

According to employers and several experts, raising the retirement age is necessary and beneficial:

The proposed reversal raises many concerns among employers’ organisations and experts. The Polish Employers’ Association Lewiatan points out that it will reverse the trend of a rising employment rate for older workers and lead to discrimination against women, as well as reducing incentives for life-long learning. Experts also point out that the change will deepen the deficit in the social insurance system. It would also not lead to the creation of new jobs for young people.

The change runs counter to the recommendations presented in the European Commission’s White Paper on Pensions (2012), which underlines the necessity to prolong working lives. Maintaining different retirement ages for men and women will also significantly increase the risk of low pension levels and of a higher share of minimum pensions being paid to women in the future (Chłoń-Domińczak & Strzelecki, 2013). This proposal does not refer to the increased risk of poverty for women.

With this latest reform Poland continues to move further away from the pillar model that was adopted throughout Central and Eastern Europe in the 1990s and 2000s.

After the revolutions of 1989, many formerly communist states transitioned from a "pay-as-you-go" (PAYG) pension system to a "pillar" system. In PAYG systems pensions are paid by a tax on labor. As the workforce ages this becomes more and more of a problem because an increasing number of retirees need to be supported by a shrinking pool of workers. Pillar systems seek to address this problem by augmenting the PAYG system ("pillar I") with privatized savings accounts or occupational pension schemes ("pillar II"). Either way, the effect is that pensions become (partially) funded by worker's savings.

Why the pillar model? Well, in part because it was promoted by the World Bank:

Before 2008, a majority of countries in the region had reformed their pension systems along the model laid out by the World Bank (WB) in its influential 1994 report, Averting the Old-Age Crisis.

[...]

In the first-wave of reforms in the late 1990s and mid-2000s, the majority of CEECs pursued pension privatization by implementing a three-pillar pension system [...] These pillars comprised: a publicly financed pillar – based on the pay-as-you-go (PAYG) principle; a compulsory fully-funded second pillar; and a voluntary fully-funded third pillar. The Czech Republic and Slovenia were the only countries that did not implement this WB-style pension reform. They pursued only parametric reforms in their state-run PAYG schemes.

The pillar model was based on the neoliberal policies of the "Chicago Boys" in Chile in the 1970s and 1980s:

Nothing illustrated Chile’s conversion to the cause of free-market economic liberalism in the 1970s and ’80s like the country’s funded, privately managed pension system. Inspired by economist Milton Friedman’s landmark book, Capitalism and Freedom, José Piñera, Labor and Pension minister during the dictatorship of then-president Augusto Pinochet, introduced revolutionary reforms in 1981 that overhauled the country’s pay-as-you-go social security system.

The transition from a PAYG system to a pillar system comes at a cost. In a pure PAYG system pensions are paid for by taxing labor. In the transition to a pillar system, you still need to pay out the existing retirees but at the same time you also need to divert money towards pillar II savings accounts. This creates a gap which needs to be financed somehow, e.g. through government debt.

For the formerly communist countries in Central and Eastern Europe this transition was particularly difficult. As their economies staggered into capitalism they carried forward the social and political expectations of relatively generous social programs while struggling with low population growth and low productivity. In joining the European Union they also took on obligations to limit public debt and budget deficit as mandated by the Stability and Growth Pact (SGP).

IPE -- Central & Eastern Europe: Are CEE pension systems safe? (Jan 2013)

The CEE countries face similiar demographic challenges that endanger the long-term financial stability of their pension systems. Increasing longevity places a greater burden on financing current and future pension benefits, whereas decreasing fertility has cut the number of workers able to pay social security contributions.

Governments reformed their pension systems in the 1990s by changing their pay-as-you-go systems and introducing funded pension pillars. In most cases, new pension funds emerged as mandatory institutions managed by private pension fund companies. This is an example of public-private partnership – whereas administration and asset management is outsourced to commercial companies, pension contributions have been carved out from mandatory pension systems.

The Central and Eastern European states were faced not only with considerable transition costs over a long period of time but also with the challenge of performing a socio-political shift towards neoliberal notions of personal responsibility and the primacy of the free market:

The most profound, and the least visible, outcome of these reforms was a shift of various risks directly to the individual. The introduction of funded pillars brought about a change in the calculation of future pension benefits – before the reforms these were computed on the basis of defined benefit (DB) formula and now they are based on defined contribution (DC). In countries like Poland and Latvia, the DC system was also introduced to the pay-as-you-go pillars and others, such as Bulgaria and Romania, decided to use point systems reflecting individuals’ contribution to the system.

A switch to a DC system results in lower redistribution. What is more, members not only face higher investment risk (due to greater reliance on funded pillars) but also hazard taking wrong decisions (concerning choice of a fund, investment policy and the timing of these decisions).

When the financial crisis hit in 2008, the value of investments in the pillar II funds plummeted, delivering a sharp blow to the confidence in the privatization of the pension system. At the same time the economic downturn decreased tax revenues, which further increased pressure on state budgets. But the ability of states to take on more debt was curtailed by the Stability and Growth Pact, which stipulates a 60% debt-to-GDP ceiling and a 3% budget deficit.

The situation for Eastern and Central European states was exacerbated by the adoption in 2009 of a new methodology to calculate "medium-term objectives" (MTO). This new methodology included "implicit government liabilities"1 -- i.e. future pension claims -- as a part of the state's liabilities.

Poland and Hungary argued for leniency with the European Commission with regards to the implicit liabilities incurred in moving from a PAYG system to a pillar system (the transition cost), but the Commission was cagey, committing only to partial and temporary relief:

EurActiv -- Poland, Hungary at odds over pension reform ahead of EU summit (Dec 14, 2010)

Polish officials have said the agreement would allow Poland to have a budget deficit of up to 4.5% of economic output, 1.5 points more than the official ceiling, without facing the EU's disciplinary steps.

[Commission spokesman Amadeu] Altafaj would not confirm the figure and said that to count on leniency, a country's public debt must be below 60% of gross domestic product.

[...]

Poland and other budget reformers have fought for permanent fiscal leeway, but Altafaj said it will only be temporary.

Being squeezed on one end by the Stability and Growth Pact and on the other by unsustainable pension liabilities while the financial crisis decimated pillar II savings accounts, Hungary decided to basically seize the savings account to prop up the state budget:

In the meantime, Hungary effectively dismantled its pension reform. Hungarian lawmakers voted to roll back a 1997 reform of pensions on Monday, effectively allowing the government to seize up to 10 billion euros in private pension assets to cut the budget deficit while avoiding austerity measures.

[...]

But the strategy – which also includes regaining "financial sovereignty" by ending a 20 billion euro safety net deal with the European Union and the International Monetary Fund – has worried investors, caused losses in Hungarian assets, and prompted a downgrade by Moody's ratings agency last week to Baa3, the lowest investment grade.

FT -- CEE governments erode occupational pensions (May 6, 2012)

Discussions about pensions in Central and Eastern Europe (CEE) used to focus on details. These included the low permitted percentage of overseas investment and whether regulations made managers too cautious. Now there are bigger problems: mismanagement of workplace pensions in many CEE countries has left savers and providers alike disillusioned.

The worst example is Hungary, where workplace pensions were effectively nationalised in 2010, and the government used the assets to deal with its budget deficit.

The move was decried as a blatant raid on private assets and the Hungarian government did little to assuage such concerns. Quite the contrary:

EurActiv -- Hungarians accuse Orbán of stealing their pension money (Nov 27, 2014)

Hungarian Tamas Merei believes his government is going to take away the €20,000 he has in his pension pot.

“This is theft,” the 39-year-old software developer said as he marched with about 3,000 other protesters to parliament on the banks of the Danube this week to protest against Prime Minister Viktor Orbán’s planned changes to pension fund rules.

[...]

Economy Minister Mihály Varga told public radio that people were “foolish” to suggest the government was stealing pensions. Government spokesman Zoltán Kovács said that, legally, the pension pots affected belonged to the state, not the savers.

“This is an illusion of having their own money,” he said.

While it is evident that long-term problems cannot be solved by short-term solutions, sometimes short-term problems are so pressing that you need a short-term solution. To illustrate the scale of the problem: the appropriation of the privatized savings accounts helped Hungary reduce its debt-to-GDP ratio by 6% and turned the budget deficit into a surplus.

Although the government move set off howls of protest from the private sector and international agencies, the short-term gains for Hungary were undeniable: The public-debt-to-GDP ratio dropped from 83 percent to 77 percent, and the budget moved from a deficit to a large surplus in 2012. The government was able to retire its bonds and sell the equity portion of the pension holdings. This meant a huge cash windfall for the government, helping to reduce its borrowing costs and improve its credit profile. “So in the short term, the move was positive,” says Timothy Ash, London-based head of emerging-markets research at Standard Bank. “The problems are over the longer term because the state assumes all the liabilities of pensioners.”

After Hungary, Poland also began dismantling its pillar system in 2011, sharply reducing the amount people could contribute to the pillar II savings accounts and redirecting the difference to the publicly funded national security scheme (pillar I):

EurActiv -- Poland saves on pensions to cut budget deficit (Mar 29, 2011)

The pension reform, adopted by the lower house of the Polish parliament, slashes from 7.3% to 2.3% the proportion of an individual's salary that can be paid into private pension funds. The 5% difference will be paid into Poland's national social security scheme, or ZUS.

[...]

The government has said the move is crucial to enable the state to keep paying out pensions from the indebted ZUS scheme's coffers, thus reducing pressure on the state budget.

In 2014 the Polish government adopted the Hungarian 'solution' almost wholesale and proceeded to simply seize the pillar II funds. As with Hungary, the move immediately improved debt-to-GDP ratio and the budget deficit:

FT -- Poland pension reform reversal highlights public disillusion (Feb 5, 2014)

The Polish government this week seized $51bn of privately run pension funds and transferred them back into state control in a sharp reversal of a reform that central and eastern European countries had embraced to help develop capital markets after the fall of communism.

[...]

The government will cancel the bonds it has taken, increasing its pension system’s long-term liabilities. The move is set to dramatically improve Warsaw’s finances as well as help close the funding gap. As a result, the government will be able to run a budget surplus, compared with 2013’s 4.8 per cent deficit.

Of course once you start raiding savings accounts to balance the budget it becomes hard to stop. This undermines trust, especially in light of election promises by the recently elected PiS (Law and Justice) party:

Fortune -- Polish Firms Fear Government Pension Plunder (Jul 2, 2016)

A growing number of Polish firms are preparing share buybacks because they fear the government plans to plunder stocks from privately run pension funds to plug holes in the state budget, company chiefs and fund managers say.

[...]

The government, which came to power in an election last October, faces a struggle to keep down the budget deficit, especially since launching a child subsidy programme in April which was part of its election platform.

The post-2008 pension reforms in Poland and Hungary are part of a second wave of reforms in much of Central and Eastern Europe which more or less gradually roll back the pillar II reforms:

Across Central and Eastern Europe, the retreat from so-called Pillar II pensions — compulsory private pension funds intended to supplement overburdened state social security — has turned into a rout. At one extreme is Hungary, which has closed down its private pension funds and expropriated their assets. At the milder end of the spectrum, the Baltic states have temporarily reduced the amount of pension contributions funneled into privately managed funds, using the money to plug budget gaps created by the global financial crisis.

Orenstein explains the move away from neoliberal principles in part as a crisis of faith:

The global financial crisis of 2008-2010 seems to have halted, at least temporarily, the trend towards mandating savings in individual, funded pension accounts worldwide, the core reform of the pension privatization trend.

[...]

The severity of the crisis also had the effect of convincing many people that the fundamental model of free market capitalism was flawed. Rather than being a path towards higher productivity and efficiency, more people now see free market capitalism as crisis-prone and potentially dysfunctional (Stiglitz, 2010; Birdsall and Fukuyama, 2011).

[...]

The global financial crisis forced significant structural changes in the international financial institutions that advocated pension privatization. [...] The World Bank, under the leadership of Robert Zoellick, shifted away from a strict focus on free market liberal policies and began to advocate “inclusive and sustainable globalization”, both environmental and social. World Bank advocacy of pension privatization appeared not to be a part of this agenda. Changes were also afoot at the International Monetary Fund (IMF). In exchange for a three-fold capital increase to USD 750 billion, the IMF agreed to reduce its use of neoliberal policy conditionalities, focusing instead on fiscal and monetary management.

Idle thoughts

It is hard to overstate the social impact of pension plans. Few things instill a sense of societal failure like the sight of old men and women scrounging about for food.

Pay-as-you-go retirement schemes are not sustainable in most of Europe because of the post-WWII population explosion and the scant population growth in recent decades. Reform of some sort is unavoidable.

The reforms of PAYG systems in the former communist states during the 1990s and 2000s aimed to address the sustainability problem. But they did more than that. They also aimed to boost capital markets, increase labor market participation and stimulate economic growth as part of a broader neoliberal agenda2. The main tenet being that the free market will provide, if only you accept its discipline.

The discipline arrived: first in the form of strict enforcement of the Stability and Growth Pact, then by years of austerity politics following the financial crisis in 2008. But the market never delivered: the 2008 crisis decimated the pillar II funds and left pensioners holding the bag, while the fund managers charged hefty fees and banks saw their reckless financial management rewarded with a tax-funded bailout. All this on top of larger than expected transition costs.

The widespread disillusionment that ensued was and is being used by (neo)reactionary politicians who opportunistically promote policies that are not so much against neoliberalism as simply against liberty. But the opposite of "neoliberal" is not "illiberal". A retreat to some imagined golden age does not address the very real challenges of labor participation, demographic change and globalization. Poland and Hungary still don't have sustainable pension systems, but now they also have a penchant for inward- and backward looking policies that curtail the freedom of the press, undermine the independence of the judiciary, and scare off foreigners.

The point here is not to argue against or in favor of neoliberalism. The point is that to force social, economic and political integration within the EU by way of policies that pursue rapid economic convergence with Olympian disregard for inequality and uncertainty is to open the door to a politics of resentment that risks fracturing the Union. This is dangerous, especially now that the EU faces a multitude of challenges at once -- not only in the periphery (Spain, Greece) and among the founding members (UK, The Netherlands), but also in the heart of Europe (Poland, Hungary).

The leaders of Europe could do worse than to brush up on Dale Carnegie:

Dale Carnegie -- How to Win Friends and Influence People

Forget about the benefits to yourself and concentrate on the benefits to the other person.

Further reading

A report card:

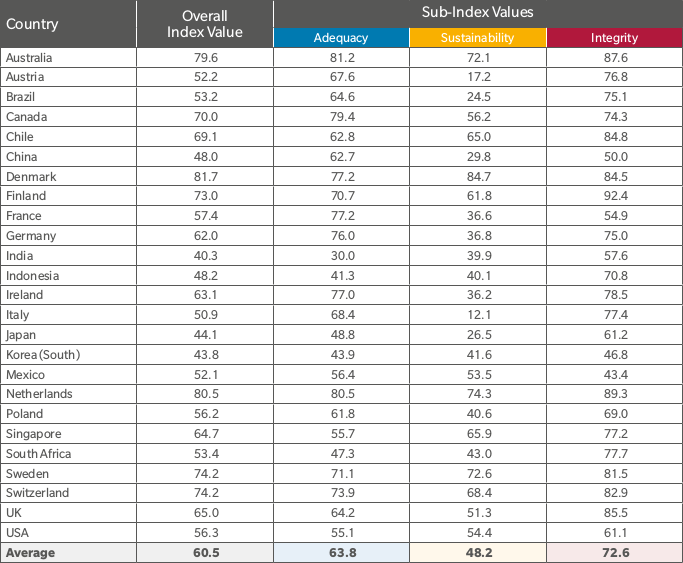

Melbourne Mercer Global Pension Index (Oct 2015)

World Bank -- Averting the Old Age Crisis (1994)

Systems providing financial security for the old are under increasing strain throughout the world. Rapid demographic transitions caused by rising life expectancy and declining fertility mean that the proportion of old people in the general population is growing rapidly. Extended families and other traditional ways of supporting the old are weakening. Meanwhile, formal systems, such as government-backed pensions, have proved both unsustainable and very difficult to reform. In some developing countries, these systems are nearing collapse. In others, governments preparing to establish formal systems risk repeating expensive mistakes. The result is a looming old age crisis that threatens not only the old but also their children and grandchildren, who must shoulder, directly or indirectly, much of the increasingly heavy burden of providing for the aged.

For these reasons, many economists and policymakers are seeking information and advice about old age security arrangements. But there are still too few who are aware of the impact these arrangements have on such diverse concernis as poverty, employment, inflation, and growth. Averting the Old Age Crisis: Policies to Protect the Old and Promote Growth is the first comprehensive, global examination of this complex and pressing set of issues. The culmination of a tvo-year research project. it synthesizes what is known, analyzes the policy alternatives, and provides a framework for identifying the policy mix most appropriate to a given country's needs.

The conference brought together well over one hundred delegates from 24 countries and six international institutions. The topics discussed during the workshop brought out many of the issues that define the interplay between the state and the market that lie at the heart of economic transition, such as:

- What is necessary to ensure states’ capacity to honour pledges on future retirement payments?

- Do we trust the financial industry with managing our long-term savings?

- Are we confident that individuals with little experience in capital markets can make informed investment choices?

- And what does it take to build a domestic base in long term savings and reduce reliance on volatile capital flows?

Edward Whitehouse -- Reversals of systemic pension reforms in Central and Eastern Europe (2011)

The late 1990s and early 2000s saw a wave of pension reforms in Central and Eastern Europe. Nearly all of these reforms saw systemic change to retirement-income provision: the introduction of individual, defined-contribution pensions as a substitute for part of public pension provision. Notable exceptions to this trend were the Czech Republic and Slovenia. However, legislation to introduce individual accounts is, at the time of writing, before the Czech parliament.

The global financial and economic crisis had a profound impact on retirement-income systems of all different designs: see Whitehouse (2009) and OECD (2009), Part I.1. The most obvious effect was the reduction in the value of assets in private pensions by 23% -- or more than USD 5 trillion during 2008. But public pensions were also affected. Falling employment along with slower growth or even declines in wages hit the revenue side. In some countries, the expenditure side was hit by workers losing their jobs and choosing to retire early. Moreover, the crisis has left most OECD with large public budget deficits and rapidly rising public debt. Economic output in most of the countries of Central and Eastern Europe was hit harder than the OECD as a whole. Assets in private pensions, however, lost somewhat less than the OECD average in Hungary and Poland, and substantially less than the average in the Slovak Republic.

In this difficult economic context, Central and Eastern European countries changed their pension systems again. These reforms encompassed parametric reforms, such as increases in pensionable ages in Estonia and Hungary. There were also reversals of the systemic reforms in different ways. In Estonia, for example, there was a temporary diversion of contributions to individual accounts to the public pension system. The intention is that these will resume. In Poland, the reversal was partial: approximately half of the contributions going into individual accounts will be moved back to the public scheme in the medium term, with a rather higher proportion for the next few years. In Hungary, the reversal is permanent: not only will all contributions revert to the public scheme in future, but all the assets in private pensions were appropriated by the government.2

OECD -- The Chilean pension system (1998)

The introduction in the early eighties of a privately managed pension system in Chile, based on individual capital accounts, has attracted world-wide attention. This reform - as well as other market oriented structural changes - and the significant improvement in Chilean economic performance has led many observers to conclude a direct link, especially through the rise in private domestic savings generated through the new pension system.

[...]

The Old Regime

In the 1920s, Chile implemented a social security system aimed at providing retirement income for the elderly as well as other social benefits.

[...]

During the first decades of operation, the ratio of contributors to pensioners generated a sizeable surplus in the system. Among other problems, this generated incentives to increase benefits that were not sustainable when the system matured. Confronted with the option of reducing benefits or generating a fiscal surplus to finance the pension system deficit, the governments chose to raise the contribution rates. While in 1955 there was one pensioner for every 12.2 active affiliates, by 1980 this ratio had changed to 2.5 active affiliates for every pensioner.

The New Pension System

The reform of the Chilean pension system -- implemented in late 1980 and early 1981 -- replaced the pay-as-you-go regime with a fully-funded pension system based on individual capital accounts, managed by private companies known as Administradoras de Fondos de Pensiones (AFPs).

Nothing illustrated Chile’s conversion to the cause of free-market economic liberalism in the 1970s and ’80s like the country’s funded, privately managed pension system. Inspired by economist Milton Friedman’s landmark book, Capitalism and Freedom, José Piñera, Labor and Pension minister during the dictatorship of then-president Augusto Pinochet, introduced revolutionary reforms in 1981 that overhauled the country’s pay-as-you-go social security system. As a result of those changes, workers are required to contribute 10 percent of their salaries to 401(k)-style funds, known as administradoras de fondos de pensiones, or AFPs, which invest the money in a variety of fixed-income and equity securities at home and abroad [...]. This system has allowed Chile to build up one of the world’s biggest pools of retirement capital — $162 billion, or 62 percent of gross domestic product — and has served as a model for more than 25 countries around the world, from Colombia to India to Russia. Piñera, whose brother Sebastián would later serve as president, from 2010 until this March, was celebrated as the pension reform pied piper by the Wall Street Journal.

Today the private pension system is at the center of a new inflection point in Chilean politics. Michelle Bachelet, a Socialist Party politician who returned to the presidency in March, is preparing to embark on the biggest revamp of the country’s pension system in its 33-year history. Arguing that the system leaves too many Chileans without retirement security and carries excessive costs, Bachelet wants to introduce a new, state-run AFP to compete with the private pension funds. The recommendation has provoked a howl of protests from existing pension fund managers, which include some of the biggest names in global finance, and warnings from economists that Chile runs the risk of stifling its economic dynamism with an increasingly powerful state.

[...]

After leading a coup that overthrew Socialist president Salvador Allende in 1973, Pinochet cut back the state’s role in the economy and made Chile a virtual testing ground for liberal policies, many of them drafted or inspired by economists from the University of Chicago, such as Friedman. Over the ensuing decades prosperity blossomed: The country boasts the highest standard of living of any major Latin American nation, with per capita GDP of $15,458 in 2012, according to World Bank data. Growth has averaged 4 percent a year for the past five years, and inflation is projected to be 3.5 percent this year. Unemployment stands at 6 percent, one of the lowest rates in Latin America, and the government runs a modest structural budget deficit of 0.98 percent of GDP, according to the International Monetary Fund.

Yet the fruits of that prosperity have not been widely shared. According to the World Bank, Chile’s Gini index, which measures the distribution of income on a scale of zero to 100, with a higher number reflecting greater inequality, stood at 52.1 in 2009 (the latest figure available), compared with 46.1 in Argentina and 36.3 in Uruguay. Of the 34 members of the Organization for Economic Cooperation and Development, Chile has the biggest gap between rich and poor.

Forbes -- Chile's Fabled Retirement System: Why Fix It? (Sep 29, 2015)

Since its launch 35 years ago, Chile’s retirement system has been hailed as “best in class” by pension experts near and far. The country’s fabled individual and privately-managed accounts include around 10 million affiliates, hold $160 billion in investments, and pay retirement benefits to over a million retirees. So why did President Michelle Bachelet establish a Pension Reform Commission that just delivered to her 58 specific reforms and three comprehensive proposals to overhaul remodel Chile’s retirement system?

Footnotes:

"unfunded commitments that are not necessarily backed by law or contractual obligations, but rather grounded in strong expectations by the public, e.g. pension expenditure or liabilities arising in connection with support to the financial sector in times of crisis" (52006SC0751).

Mitchell A. Orenstein interpreted the widespread adoption of the Chilean retirement scheme as a part of a broader neoliberal agenda for global economic policy:

Mitchell A. Orenstein -- The New Pension Reform as Global Policy (2005)

Abstract

This article analyzes the emergence and spread of the new pension reforms, a set of privatizing reforms that is part of a broader neoliberal agenda for global economic policy. The new pension reforms are significant both because they revolutionize the post-war social contract and because global policy actors have been involved directly in their implementation in more than 25 countries around the world. In this sense, the new pension reforms are a case of global policy. This article defines the scope of global policy, explores the content of the new pension reforms, and shows the new pension reforms to be a global policy in their development, transfer, and implementation.